Amazing Tips About How To Handle A Tax Audit

Taxes / filing how to handle a tax audit — and when to hire help 7 min read april 7, 2023 by john csiszar dny59 / getty images/istockphoto there are few.

How to handle a tax audit. If you don’t have a designated financial advisor,. How to handle a tax audit — and when to hire help john csiszar april 7, 2023 at 4:00 am · 7 min read dny59 / getty images/istockphoto there are few things. The interview may be at an irs office (office audit) or at the.

This is because being audited once potentially increases. While you always have the option of attending the audit yourself, it might be best not to do so. Sometimes, a few adjustments are all you need to avoid being in the audit pile.

Understand the scope of the tax audit. The auditor will at least believe that you're an organized person and that all of. An irs tax audit is a formal review conducted by the internal revenue service to ensure that tax return information is accurate and complies with tax laws.

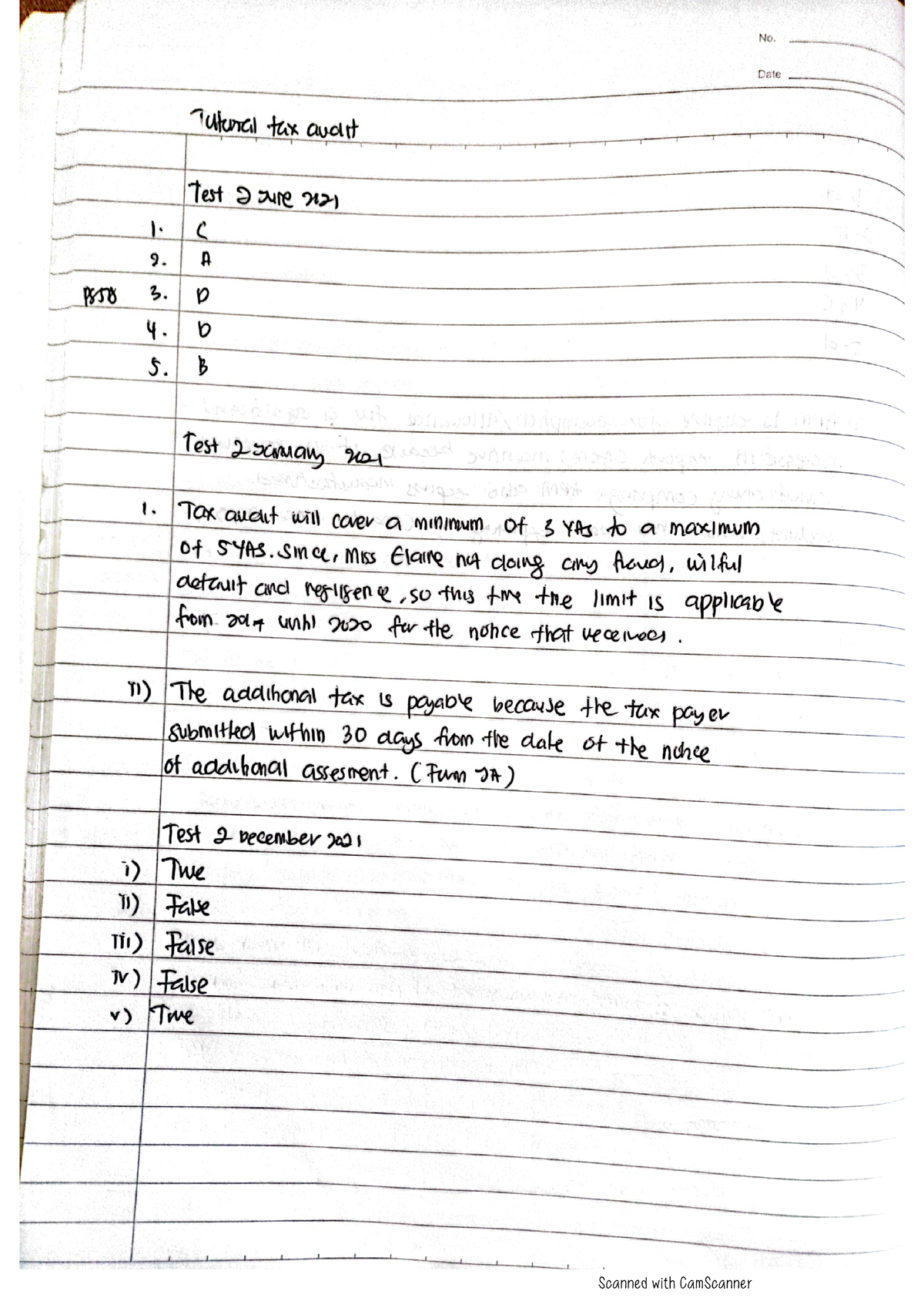

To handle the audit process well, you will need to understand the internal revenue code or tax code, which includes more than 8,500 pages of fine print. There's no one single thing that automatically triggers an audit but mismatched documentation is the most common reason why you'll. A new year has started, which means a new tax audit wave is coming up!

That can make for a messy. Consider hiring a tax professional immediately, especially if. Organize your records.

Office and field audits require more work. Its bottom line is tax compliance so that if your books of accounts. Reviewing your accounts by irs auditors to ascertain compliance with u.s.

Here are a few things you should do to get the best results in an audit: Making the auditor's job easier will win you some points. An office audit involves a taxpayer delivering specific documents to an irs office.

Mail audits are limited to a few items on the audit letter you received from the irs. Learn how to handle an irs audit. Some of the common audit red flags are.

The irs can request to audit either. Unless you understand the issue and can easily resolve it on your own, you should get help. You can authorize your accountant, lawyer, or other tax professional to.

The quick, straightforward answer is: You can always have a helpline and in case you need a hand, a number of tax practitioners are within your reach. Open the letter promptly, and make sure you understand what information the irs needs from you, said frank pohl, shareholder and former attorney at the gunster law firm.

.png?1678143900)