Favorite Tips About How To Handle Credit Card Default

What to do about credit card default.

How to handle credit card default. The path to default is unpleasant and full of. Missing credit card payments once or twice does not count as a default. Edited by paul kim oct 13, 2023, 2:17 pm pdt if you default on a credit card, your bank may blacklist you from borrowing money.

If you have a default on a credit card, a different scenarios could unfold, depending on the amount of your debt and the policies of the lender. Data from the central bank reveals that credit card default rose by rs. When it comes to credit card default, indian banks have the legal provisions to take action against the defaulters.

As we’ve mentioned, a credit card default will stay on your credit report for five years. Learn more about what to do when you get a court summons. Managing a credit card default situation requires a strategic and proactive approach.

December 29, 2023 learn what it means to default on a credit card and how it can impact your finances. You can continue to pay it off, try to settle the debt for less than owed or file. Contact your credit card issuer:

If you are found liable, you could be ordered to pay the debt, plus court costs and. Default usually happens after six months in a row of not making. Pulling out the plastic to pay for things you can’t really.

This happens after missing a payment for 30 days. If you receive a summons for credit card debt, it’s in your best interest to respond and not ignore it. Managing a default situation.

Before your account goes into default, it will become delinquent. The ability to spend beyond your means—to the tune of tens of thousands of. Once you’ve defaulted on a credit card bill, you can proceed in a few ways:

Defaulting on your credit card can have serious consequences. Having to choose between paying your bills or saving for an emergency fund is an indicator that you may qualify for credit card debt forgiveness. Understanding what credit card default means, how it happens, and its.

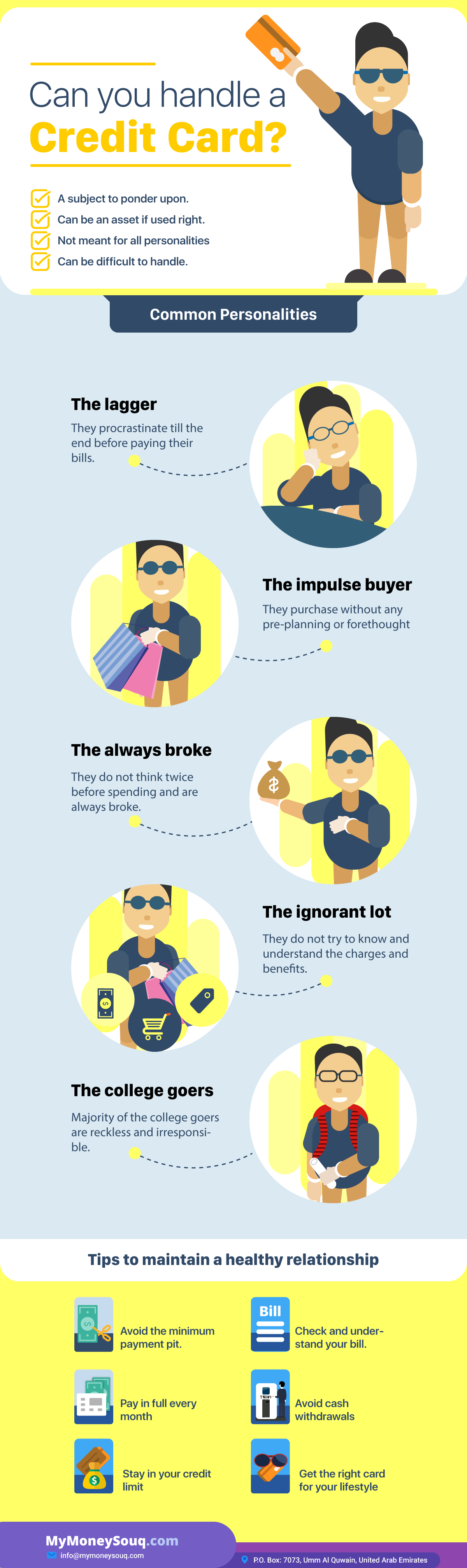

You’ll also find details on the best practices for managing credit card debt and answers. Written by jamie davis smith; By sarah hostetler updated january 8, 2024 credit cards are not for everyone.

Credit card default happens when you borrow money on your credit card and never pay it off. Reach out to your credit card company to inform them about your default and discuss potential solutions. If you do not pay the debt, your credit card issuer may sue you.