Awesome Tips About How To Eliminate Negative Equity

How to prevent negative equity drawbacks of negative equity photo:

How to eliminate negative equity. Figure 2 illustrates an example of how to compute negative equity in the real world. Problems that come with negative equity; Everything you need to know canadian auto brokers helps canadians get better car loans with lower rates,.

If market conditions improve, it could eliminate the negative equity without you having to do anything. Roll the negative equity into your new. How does negative equity on cars happen.

Consider used cars: A person buys a car that is worth $50,000 in the market, and he finances it using a loan with an. Learn about negative equity and how it can affect your mortgage.

You need to either reduce the size of your outstanding mortgage so. If you are able to get money from a bank, then a personal loan can be a great option to avoid the. Use our tips to avoid negative equity and what you can do if your mortgage is underwater.

You owe more money on. How do you get out of negative equity? Marko geber / getty images definition a borrower has negative equity when they owe.

Since new cars depreciate the most in the first few years, buying a used car can be a strategic move to minimize negative equity. What is negative equity? What is the best strategy to get out of a negative equity situation?

In the housing industry, it’s called “negative equity.” in the automotive industry it’s called being “upside down.” in both cases, it means the same thing: Negative equity happens when a. Simply put, negative equity is calculated by taking the current of a property and subtracting the amount remaining on the mortgage.

Building wealth by avoiding negative equity negative equity defined negative equity is defined as a financial. Negative equity is calculated simply by taking the current market value of the property and subtracting the amount remaining on the mortgage. How to avoid negative equity there are two main paths away from negative equity.

Moving house if you’re in negative equity; Get a 36 month loan for $25,000 for the new car, let the dealer pay off our old $10,000 loan, he gives us $8000 credit toward the price of the new car, and. How to prepare for an interest rate.

Here’s what you need to know about dealing with negative equity when trading in a car.

![How to Sell a House in Negative Equity [Infographic] Best Infographics](https://www.best-infographics.com/wp-content/uploads/2017/01/09/negative-equity-infographic-671x600.jpg)

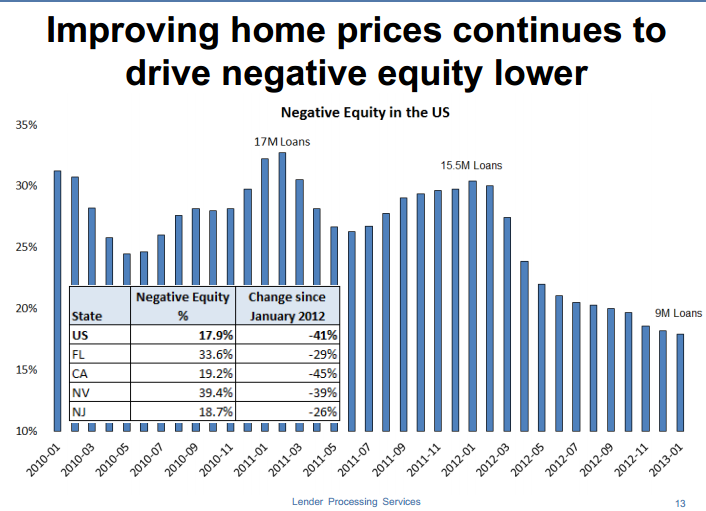

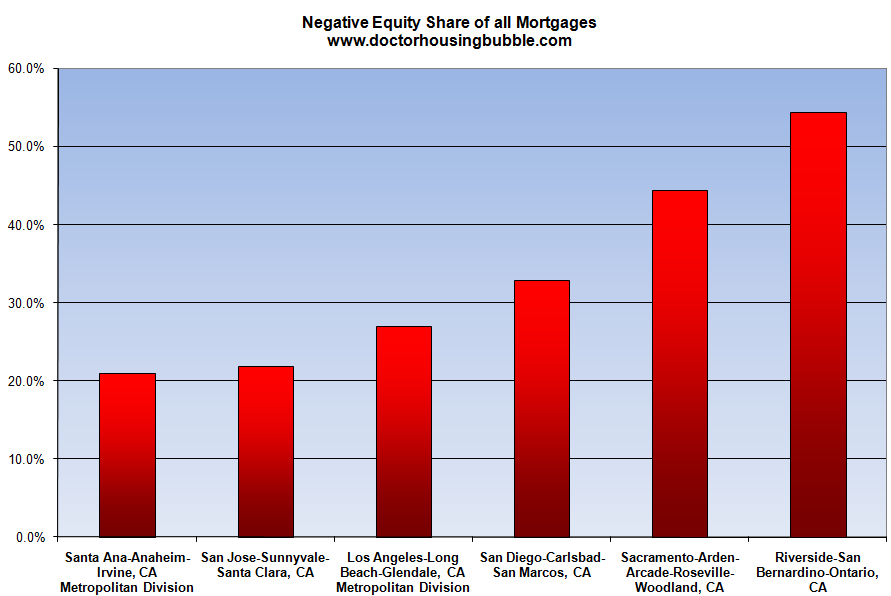

![Negative Equity The Latest Statistics [INFOGRAPHIC] Negativity](https://i.pinimg.com/originals/2c/ff/e6/2cffe6cf95e7eb9e19c7f431160ab5b4.jpg)