The Secret Of Info About How To Be Public Accountant

Apply to sit based on state requirements.

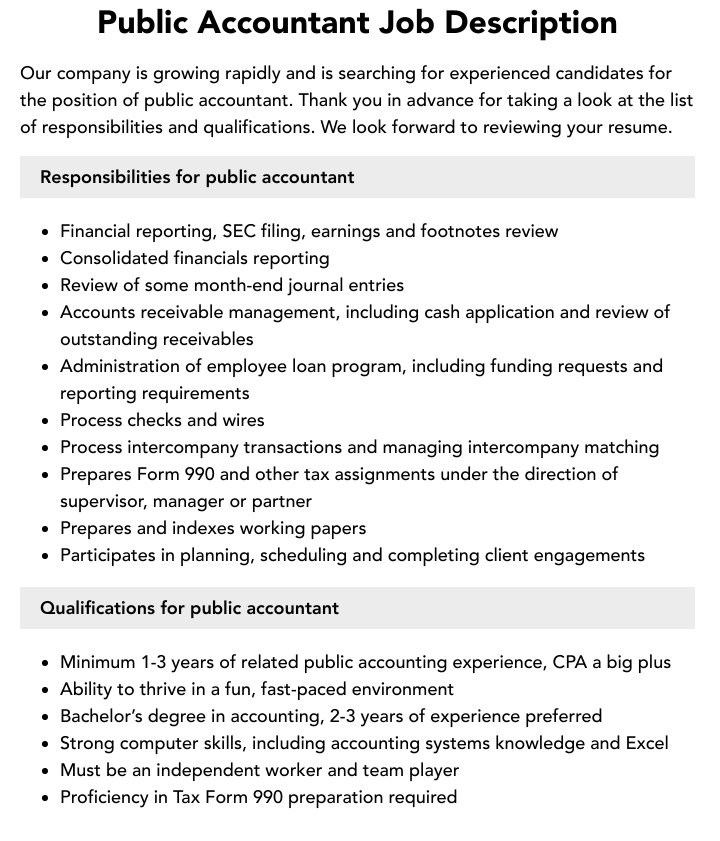

How to be public accountant. Public accounting is a term that invokes images of professionals meticulously inspecting financial records, balancing the books, and. Cpas, or certified public accountants, perform various accounting functions for corporations, government agencies, nonprofit organizations and individuals. Pass all 4 parts with a score of 75 or higher.

Here’s what tax preparers charge, on average, by fee method: 11 minute read. The key requirements for becoming a cpa are listed below.

This page covers important information. It is generally equivalent to the title of chartered. Founder of i pass the cpa exam.

How to become an accountant. However, the nature of the work and the settings in which it can be obtained (e.g., public accounting vs. This includes completing the required courses,.

For instance, new york requires at. How to become a cpa? All candidates must pass the.

If you're interested in a position within the. To become a licensed certified public accountant (cpa), you must meet the education, examination, and experience requirements. Must have a social security number.

$345 (new client), $332 (returning client) set fee per form and. The following are a few common requirements needed to become a cpa: What is public accounting?

Public accountants who meet certain qualifications can seek licensure to work as certified public accountants (cpas). To become a certified public accountant (cpa), it is important to have the necessary accounting qualifications. How to become an accountant:

Minimum fee, plus complexity fee: Learn how to produce and analyze financial statements, payroll accounting functions, and more in the intuit bookkeeping professional certificate. The skills required of a cpa are:

Complete guide to public accounting. Must be at least 18 years of age. Becoming a cpa requires passing an exam and fulfilling several education and experience requirements.