Divine Info About How To Build Yield Curve

Next, enter 2 into cell a2, 5 into cell a3, 10 into cell a4, 20 into cell a5, and 30 into cell a6.

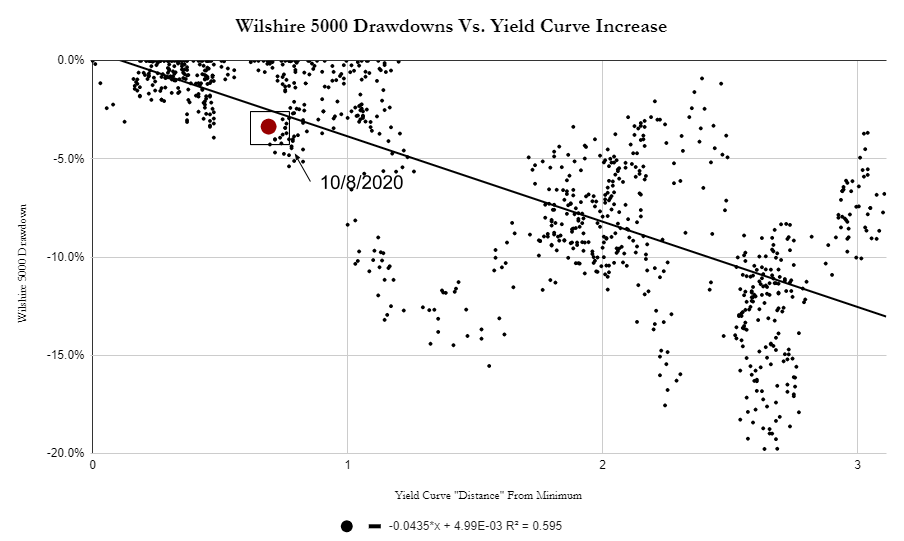

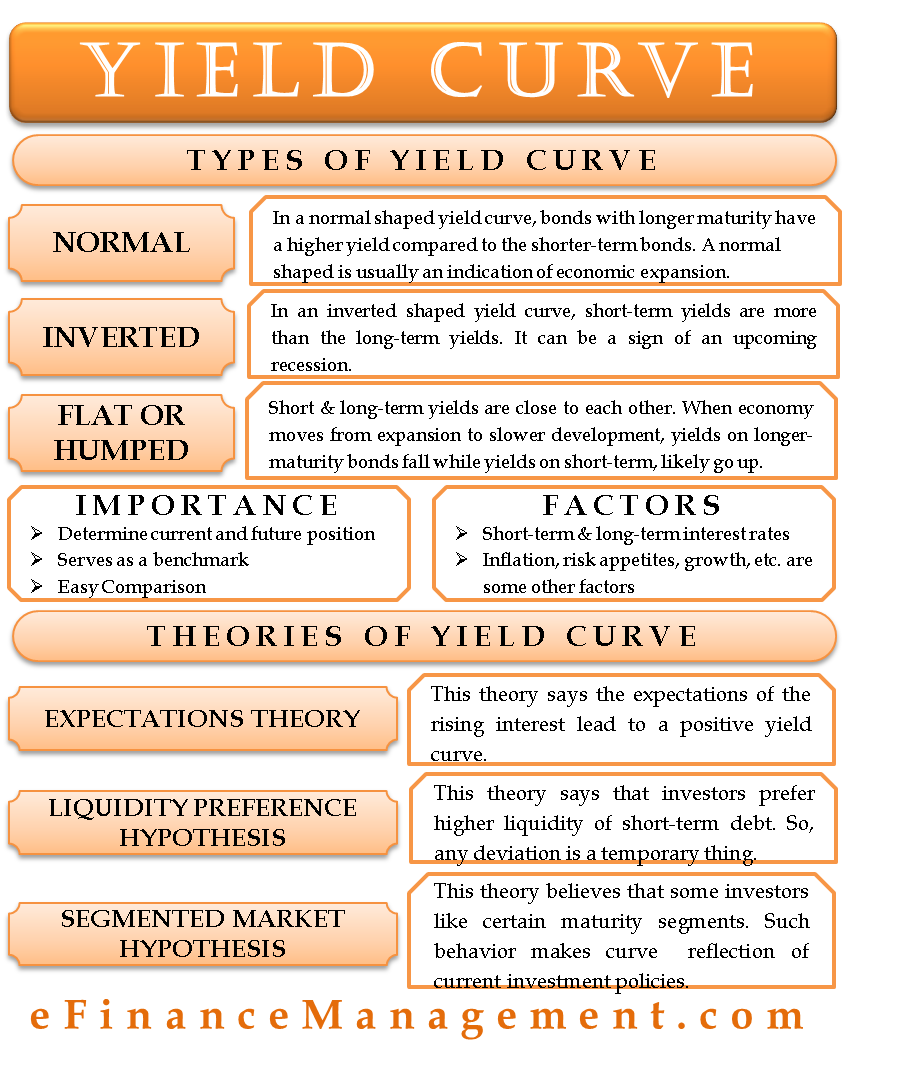

How to build yield curve. The typical yield curve shape is such that as maturity increase so to does yield which makes sense when you consider things like liquidity, time value of money, etc. Although not every variation can be explained as there are many methods in bootstrapping because of differences in conventions used. To create a useful graph of the yield curve, interest rate yields should be computed for all government bonds at all remaining times to maturity.

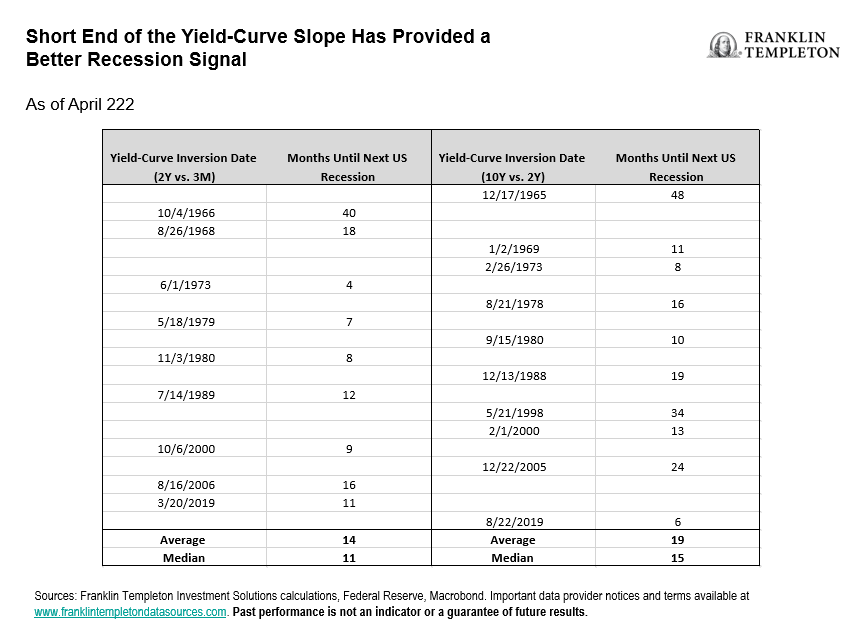

[1] for the latest, check u.s. The reason the yield curve is so revered as an economic indicator is. Choosing the appropriate chart type for visualization.

Build a single curve using bonds+bills. Actually, the shortest one is one month. The method for creating these yield curves from prices or other yield curves is called bootst.

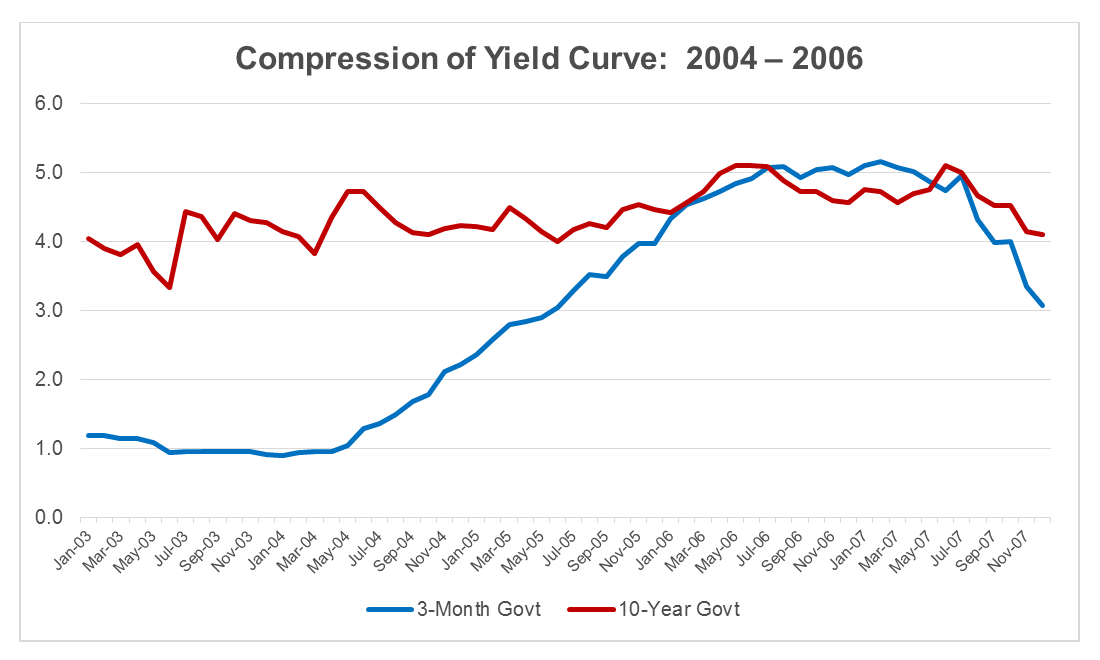

Companies use the yield curve to discount future cash flows in order to calculate the fair value of assets and liabilities. The curve might, for instance, compare the yields investors are receiving from bonds that mature in 3 months, 5 years, 10 years, 20 years. Ur wealth ur freedom 568 subscribers subscribe subscribed like share 10k views 2 years ago united states.

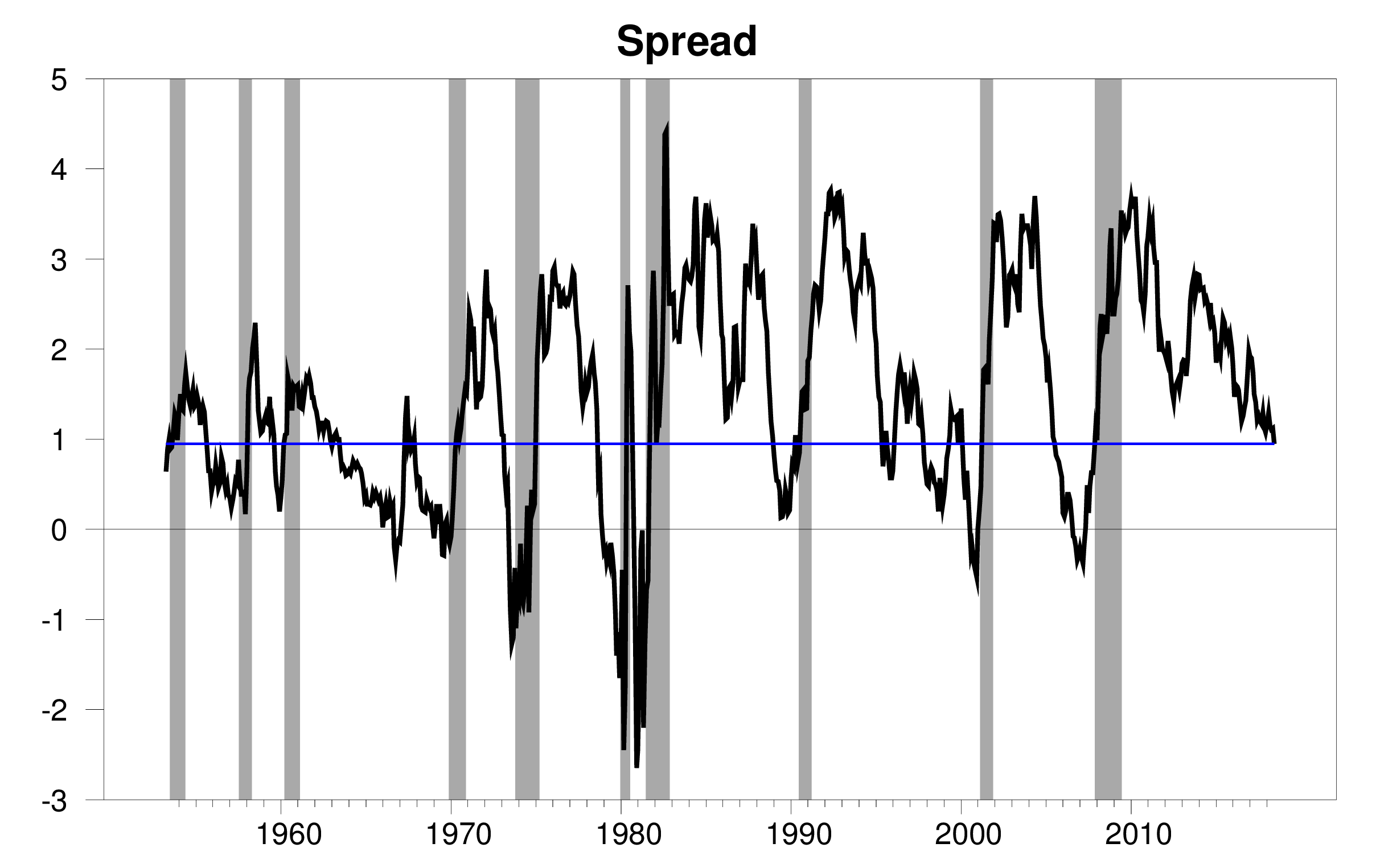

The yield curve, an important economic barometer, can help investors adjust their portfolios to see maximum gains or reduce risks. This would be something like here on our graph. In this video, we show explain a yield curve and how to make a yi.

How to create a yield curve using excel? We go through different yield curves and how to calculate them. The following bootstrapping examples provide an overview of how a yield curve is constructed.

Excel offers a variety of functions that can be used to calculate and. Oct 18, 2013 11:04am edt lmost everybody who follows financial markets has heard, at some point, a reference to the yield curve. As a result, they get an opportunity to compare the market and make decisions practically, considering the.

Once the yield data is calculated, the next step is to choose the. The procedure to build up a curve using raw can be decomposed into four steps: Most have nodded sagely as an advisor prattles on about it, but,.

Find the current shape of the yield curve. If you knew that an economic downturn was around the corner, you. You can calculate yield by dividing the coupon interest rate by a bond’s current price in the secondary market:

The graph displays a bond’s yield on the vertical axis and the time to maturity across the horizontal axis. The yield curve is a graphical representation of the interest rates on debt for a range of maturities. A yield curve, also known as a treasury yield curve or bond yield curve, is a graph, shaped like a curve, designed to help investors compare the yields of bonds of equal credit but different maturity dates.

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)